When your money sits in the bank, you earn interest. So why not earn some extra money on your stocks, gold, or oil contracts while they sit in your broker's vault? Dividends aren't the only way to make money on the stocks you hold long-term. Call options can give you some extra income on those stocks for the years they are sitting idle with your broker.

Here's a quick guide to how it works.

Call options are a right to buy a stock at a specific price between now and a future expiration date. If you buy an IBM December 125 call, it means you have the right to buy 100 shares of IBM for $125 per share any time between now and December, regardless of the market price. Even if IBM is at 159 in December, you can buy it for $125. You can also just sell the call for the difference in price between the two, and pocket the profit. However, from a seller's standpoint, you are selling the right to someone else, who may buy your shares for $125 any time between now and December. He pays you a premium, say $400, for this right, when IBM is at $119. You pocket the extra $400 income, and if the shares get pulled away from you at $125, you still have a $600 profit there too. You just make $1000 instead of the $600 you'd have made without selling the calls.

Of course, if IBM goes to $140 the next week, you might cry real tears, but there's no reason. Profit is profit, and it's never a bad thing. Never cry over a "could have made" deal, just be happy with the profits you have in hand.

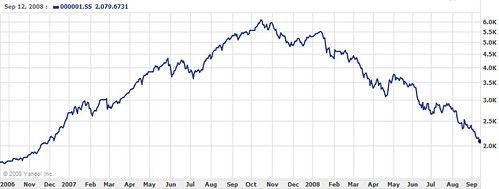

However, if IBM stays in the $117 to $124 range for many months, you'll continue to earn extra income by selling calls against your shares. When these expire, you can sell more. It's a constant stream of income. Of course, in events such as the financial crash of the second Bush administration, when most stocks fell 40%... you will still see a loss. However, the income from the calls will help take some of the sting out of it. If you own gold bars, the same principle applies, but you'll need a commodities broker to trade these types of calls on gold.

This isn't a quick fix or guarantee against buying bad stocks or investments. If you had Citibank or Lehmen shares in 2008 or 2009, nothing would have saved you. But it does create extra income against the solid stocks you own that are not built like a house of cards. Nothing is guaranteed in the stock market, not even with blue chips, so you need all the extra income you can get.

You can, however, sell deep in the money calls (calls where the stock value is already above your strike price) , when you think the stock may tumble, but you don't wish to sell the shares. If IBM is at 121 and you suspect a fall coming, sell the 115 calls, likely for $700 or more. If it falls to 114, you'll keep your stock and get enough money from the call sale to cover your losses.

The best place to start is with your existing broker. Look on their website for Options quotes, and start shopping for a proper call to sell against your shares. Sell long-term, and you should do well for yourself.

stock promoters